EU VAT laws are changing for electronic service, or ‘e-service’, providers. Today, in line with existing EU VAT rules, the VAT on e-services is charged based on the location of the merchant but, from 01 January 2015, the VAT on e-services must be calculated based on the end customer’s location.

Changes to DPD and your Sales Process

There are a number of changes that vendors have to make:

- Identify the location of their customers and collect evidence

- Validate VAT numbers for B2B transactions

- Apply the correct VAT rate and display it on invoices in destination currency

- Issue e-invoices in the destination language

- Store evidence for 10 years

- Create a quarterly EU MOSS return

- Be audit ready

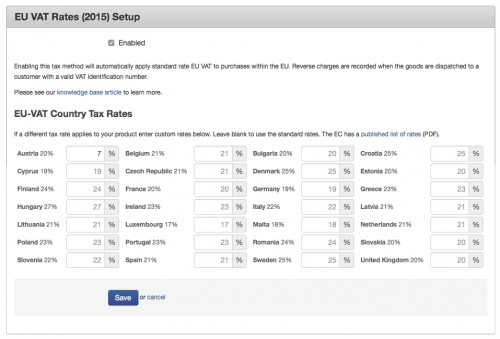

We have been busy making changes to DPD to meet the new 2015 EU-VAT regulations. These changes will be available as a new 2015 EU VAT tax class available in the tax setup section of your DPD store prior to Jan 1st 2015.

Identify the location of their customers and collect evidence

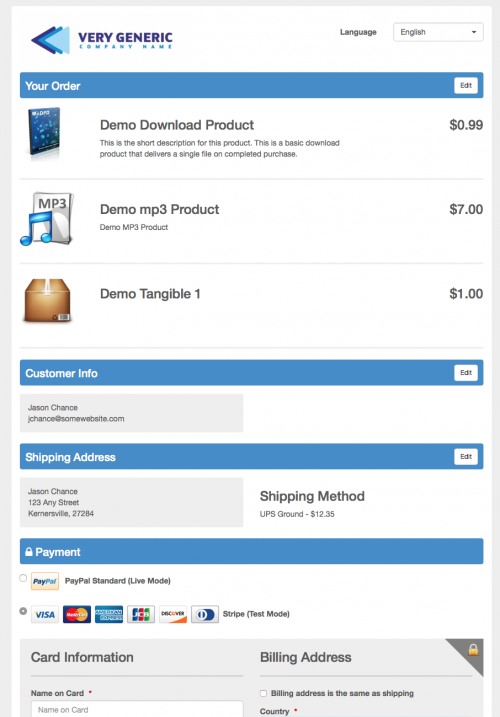

DPD already collects the shipping address for the customer and IP address and stores them with the transaction in DPD. This meets VAT location identification requirements.

Validate VAT numbers for B2B transactions

DPD verifies that VAT IDs are valid using VIES when they are entered in the cart.

Apply the correct VAT rate and display it on invoices in destination currency

DPD is changing our VAT rate calculations to meet the new destination based 2015 rules. These rules can be summed up as:

- Same zone, with VAT ID = Buyer charged VAT

- Same zone, without VAT ID = Buyer charged VAT

- Different zone, with VAT ID = No VAT charged

- Different zone, without VAT ID = Destination VAT charged

- non-EU = No VAT charged.

We will be doing automatic currency conversion, using Open Exchange Rates for the VAT amount charged at the time of sale to put the VAT amount charged in the destination country’s currency.

Issue e-invoices in the destination language

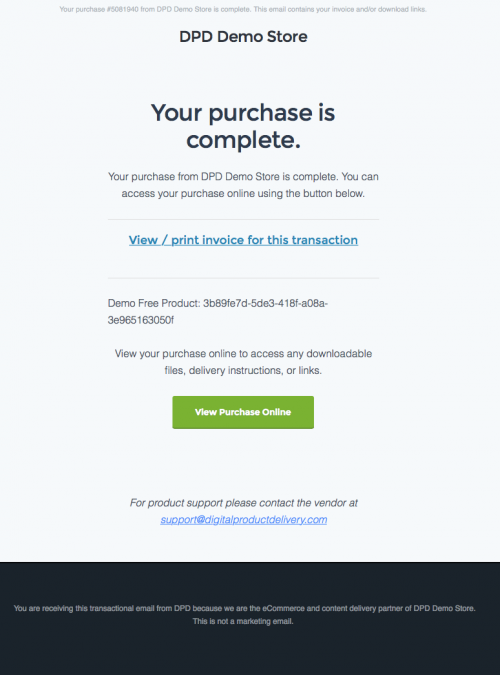

DPD has completely rewritten the invoice template to include all required information including seller and buyer address and VAT info. We have translated the entire invoice to the 26 languages commonly in use in the EU.

Store evidence for 10 years, Create a quarterly EU MOSS return, Be audit ready

We have made it easy, through a new VAT Report view to export what VAT you have charged for each country. We have also made the above changes to the invoices so that you can print them out and store a record of the transactions to meet any and all record keeping requirements.

DPD will keep your transactions for as long as you are a customer, but we are not a long-term data storage provider. You should always keep a record of your transactions for record keeping and audit compliance reasons.

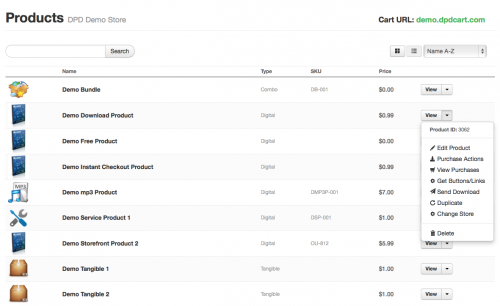

How to set up the 2015 EU-VAT Rules in DPD

On Jan 1st you will need to switch your stores over to using the new 2015 EU-VAT Tax Rules.

1. Log in to DPD

2. Go to Preferences in the left menu for each store and enter your VAT ID and location information, then save.

2. Go to Tax in the left menu for each store

3. Edit each tax class and remove any old “VAT” or “EU-VAT” rules from your existing table rate tax classes, then save

4. Enable the new 2015 EU-VAT tax rules for each tax class.

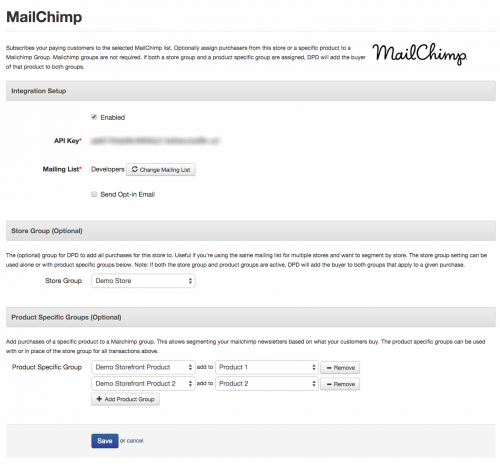

We’re happy to announce that this morning we released another often requested feature- group support for Mailchimp integrations.

We’re happy to announce that this morning we released another often requested feature- group support for Mailchimp integrations.