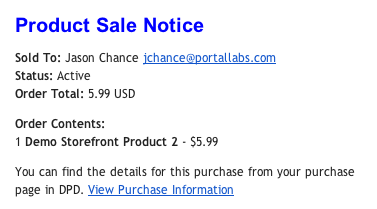

We often get asked as a pre-signup question for DPD if our system will help vendors fight chargebacks and disputes from buyers. Usually vendors have been burned in the past by unscrupulous buyers downloading their product and then doing a chargeback, leaving the vendor out of luck.

We often get asked as a pre-signup question for DPD if our system will help vendors fight chargebacks and disputes from buyers. Usually vendors have been burned in the past by unscrupulous buyers downloading their product and then doing a chargeback, leaving the vendor out of luck.

We deliver terabytes of downloads like games, music, video, graphics, and ebooks for thousands of vendors, so we’re in a pretty good position to spill the beans on this one.

They want to know if anything can prevent chargebacks for digital orders.

The short answer? No.

Why You’re Going to Lose A Chargeback

PayPal

PayPal has built their business on security and safety for buyers. This makes them nearly 100% biased toward siding with buyers when it comes to chargebacks and disputes. This is not the court system where vendors are innocent until proven guilty. In every case we have ever heard about (and trust me, we talk to a lot of vendors) PayPal seems to start with the logic that “The seller is wrong.”

We have never heard of a single case from any of our thousands of vendors where they won a PayPal dispute even with IP addresses and download logs. If a customer disputes your charge through PayPal you will lose the money, period.

Edit: A couple vendors have responded and said that they won a PayPal dispute in cases where the person who filed the dispute didn’t actually follow up on the dispute process, so PayPal decided in the vendor’s favor. So hey, at least if the person that does the chargeback is lazy you might have a chance!

We’re a PayPal partner. They’re our #1 payment processor in use with DPD and they probably wouldn’t like that we wrote this, but it’s the truth.

Just about everybody who is buying stuff online has a PayPal account. If you don’t accept PayPal then you’re turning away a huge number of sales. PayPal knows this, so they have very little motivation to change their dispute practices.

Credit Card Processors

For Visa and MasterCard the credit card processor dispute and refund polices are controlled by the issuing bank so the enforcement of chargebacks vary broadly. One chargeback might be handled by Wells Fargo and another by Chase or Citibank.

In the vast majority of cases we have heard about the only way they will side with you in any dispute case is if you can provide a tracking number and proof of delivery for the order.

By tracking number we mean a USPS, UPS, or Fedex tracking number in the US (or other carriers internationally). By proof of delivery we mean “signature required” where the person who ordered the product actually signed for the delivery. Letting UPS leave it on the doorstep without a signature doesn’t count for proof of delivery- “The neighborhood kids must have stolen it! I didn’t get it!” works for a dispute.

For Discover and American Express the policies are set by the credit card company. From what we have heard with other vendors, American Express seems to be more willing to hear the vendor’s side of the story, but as with all internet transactions the deck is still stacked in the buyer’s favor. Unfortunately, we really don’t have enough experience with Discover to offer valid feedback on them.

The trump card for all disputes? Simple- the buyer only has to assert that the item was not as described. Easy. The credit card company says you didn’t sell them what they thought they were getting, the buyer get’s their money back, and that’s it. They win the dispute.

What can you do about it?

Sadly, not much.

However, a tactic that has been said to work by some vendors is this:

Buyers are looking for instant digital delivery and you’re looking for peace of mind from chargebacks. A simple solution to this is to bundle your instant download with a tangible good. When a customer makes an order of your digital/tangible bundle, they get the instant delivery they are looking for and you ship them an item (which could be just a sheet of paper with download instructions, or a CD with a copy of their order) via the cheapest method you can with proof of delivery. In most cases in the US, that’s Postal Mail with signature confirmation.

When a dispute comes up you can reference the proof of delivery and hold off the “I didn’t get it” claims.

Of course, this comes at a price. Instead of just hanging out and collecting payments for your instantly delivered download without any action on your part you now have to mail something out in a timely maner. But, if you’re plagued with chargebacks it might just be a viable alternative to eating the lost sales.

[box]The information in this post is based on our real world experience talking to and supporting the vendors who use DPD to sell downloadable products. We welcome any outside experiences or tips in fighting chargebacks and reversals![/box]

We often get asked as a pre-signup question for DPD if our system will help vendors fight chargebacks and disputes from buyers. Usually vendors have been burned in the past by unscrupulous buyers downloading their product and then doing a chargeback, leaving the vendor out of luck.

We often get asked as a pre-signup question for DPD if our system will help vendors fight chargebacks and disputes from buyers. Usually vendors have been burned in the past by unscrupulous buyers downloading their product and then doing a chargeback, leaving the vendor out of luck.

DPD now supports

DPD now supports